Investment Memo

Outline key investment details to assess the risks, benefits, and viability of funding a startup, company, or project.

Private Equity Professionals assessing mature-scale investment risks, returns, and exit opportunities for portfolio management.

Corporate Development Teams evaluating acquisition, partnership, or market entry opportunities with innovative companies.

Board Members & C-level Executives needing clear, actionable investment decision materials for company funding approval.

Strategic Consultants preparing investment theses and competitive benchmarks for client-facing transaction support.

Venture Capital Analysts conducting startup due diligence for potential early- and growth-stage investments.

Checks against hallucinations, confabulation, and maintains process quality

Cites every claim and provides a list of used sources

Autonomous execution based on your inputs and agent instructions

Asks follow-up questions autonomously

PDF

Public Link

Included in This App

Company Overview

Map and benchmark key business signals (such as mission, milestones, operational scale, and market positioning) to accelerate enterprise due diligence, partnership qualification, and competitive differentiation.

Investment Thesis

Generates a clear, evidence-backed investment thesis for a given company by analyzing its unique value proposition, market tailwinds, and strategic fit with investor priorities—supporting confident, well-informed investment decisions.

Pain Points & Defensibility

Generates an analysis of a company’s problem–solution fit—uncovering the specific pain points it targets, assessing how defensible and differentiated its approach is, and evaluating traction through customer adoption and performance signals.

Positioning & Moat

Map a company’s durable moat and surface tactical growth moves by evaluating network effects, switching costs, and pinpointing high-potential expansion pathways.

Map and analyze a company’s global patent and trademark portfolio to uncover IP strengths, strategic gaps, and competitive positioning. The flow identifies all active and pending patents and trademarks associated with the company, verifies ownership, and structures the data by technology category, geography, and status. It then synthesizes findings into an executive-level IP snapshot highlighting defensible assets, risks, and commercialization potential for use in due diligence, investment evaluation, and strategic planning. Inputs: company name or URL (e.g., OpenAI or https://openai.com).

Business Model

Evaluate and fortify your business model by dissecting revenue streams, gauging unit economic fundamentals, and pinpointing recurring revenue dynamics. This flow analyzes the scalability of revenue sources, concentration risks, and retention factors to produce an actionable, consolidated evaluation.

Financial Journey Mapping & Capital Forecasting

Map and quantify a company’s historical financial performance (including revenue growth, EBITDA, profitability, burn rate, and cash runway) while developing clear, 3–5 year revenue and profitability projections.

TAM Assessment (for investment)

Conduct a detailed attractiveness assessment of an idea using a bottom-up methodology. This process calculates the Total Addressable Market (TAM), projects growth rates, and assesses profit margins based on fundamental business metrics and clearly stated assumptions. The final output is a consolidated table.

Competitor Signals & Substitutes Mapping

Extract competitive signals by systematically identifying and categorizing direct rivals, alternative alternatives, and substitute products. This process clarifies the market positioning for the target company and reveals strategic differentiators through data-backed insights.

Compare competitor pricing models and positioning strategies to uncover opportunities for differentiation and margin optimization. The flow analyzes how direct, indirect, and substitute competitors price and position their offerings, benchmarks a company’s approach against market norms, and identifies strategic pricing gaps to strengthen competitive advantage. Inputs: company (e.g., Tesla), and competitors (e.g., Lucid Motors, Rivian).

Analyze how market share is shifting among key competitors by identifying which companies are gaining or losing ground and why. The flow examines public data, trends, and strategic moves such as innovation, pricing, or disruptions to explain performance shifts. Inputs: a company (e.g., Apple) and its competitors (e.g., Samsung, Huawei).

Leadership & Operational Capacity

Pinpoint leadership strengths and operational talent needs by mapping founding team track records, executive expertise, and organizational capacity gaps to inform growth and investment decisions.

Evaluate the company’s workforce composition and structural readiness for scalable growth. It delivers a prioritized hiring roadmap, recommending strategic roles essential for accelerating efficiency, performance, and long-term scalability. Inputs: company (e.g., Figma).

Market Positioning & Customer Trends

Map a company’s market stance by surfacing customer behavior shifts, benchmarking whether it leads as a first mover or follows strategically, and evaluating regulatory and economic demand drivers to deliver a structured, evidence-backed positioning report.

Strategic SWOT Analysis

Drive business growth using actionable swot analysis and robust risk management strategies. Integrate capital allocation processes and precise investment recommendations for superior opportunity mapping and strategic planning.

Growth, Demand Drivers, and Risk Assessment

Map market boundaries, forecast growth trends, and integrate key demand signals with risk factors to deliver actionable market intelligence for strategic expansion and targeted investments. This flow guides you from defining market scope and analyzing growth patterns to identifying critical demand drivers and risks.

Exit Pathway & Return Trajectory Modeling

Map potential investment exit pathways and quantify resulting financial returns by combining qualitative scenario characterizations with quantitative models. This flow systematically examines IPO, M&A, and secondary sale scenarios, evaluating market conditions, regulatory frameworks, competitive positioning, and financial performance data to generate clear, actionable insights for investor decision-making

Risk Exposure Mapping and Mitigation Planning

Chart critical competitive and financial vulnerabilities and generate actionable strategies to neutralize them. Synthesize findings from both market disruption signals and funding pressures into a cohesive risk management brief that supports informed investment decisions.

Similar Apps

We don’t train on, resell or package up your data.

We are not in the business of training new models. We care about providing end-to-end knowledge work automation.

Private data is saved in a separate per-account database and not added to any public reports. You own the results of your analysis.

We have gone through multiple procurement processes that included legal, financial and technical assessments for US Fortune 500 companies.

Each App has meticulously pre-trained agents working on top of trusted data

FifthRow Apps are collections of Autonomous Agents working together to deliver comprehensive business processes and programs.

Customizable Agent Training for Vertical AI

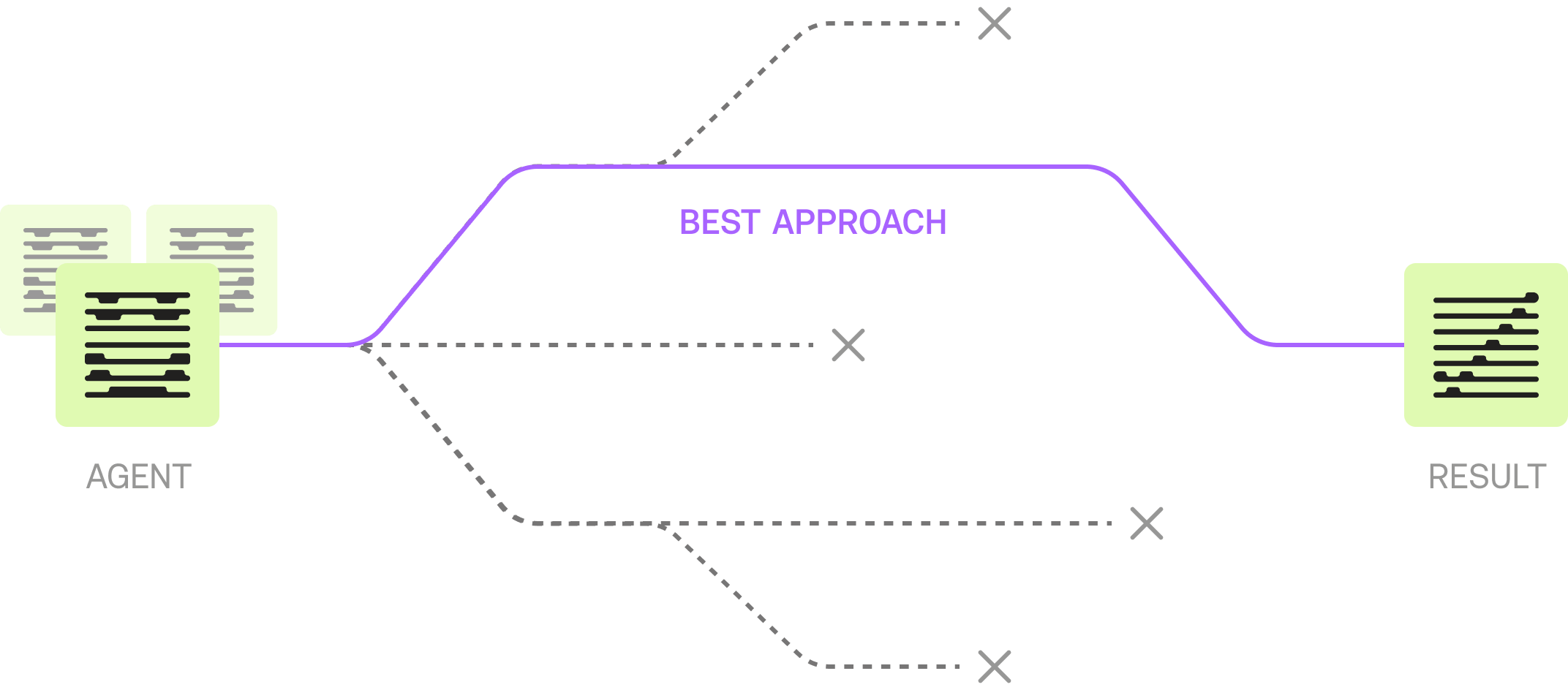

We pre-train all agents on multiple approaches to a problem. Every step is customizable and automates prompting, LLM choice and relevant data. All Apps are stress-tested 60+ times on multiple inputs for robust and consistent results.

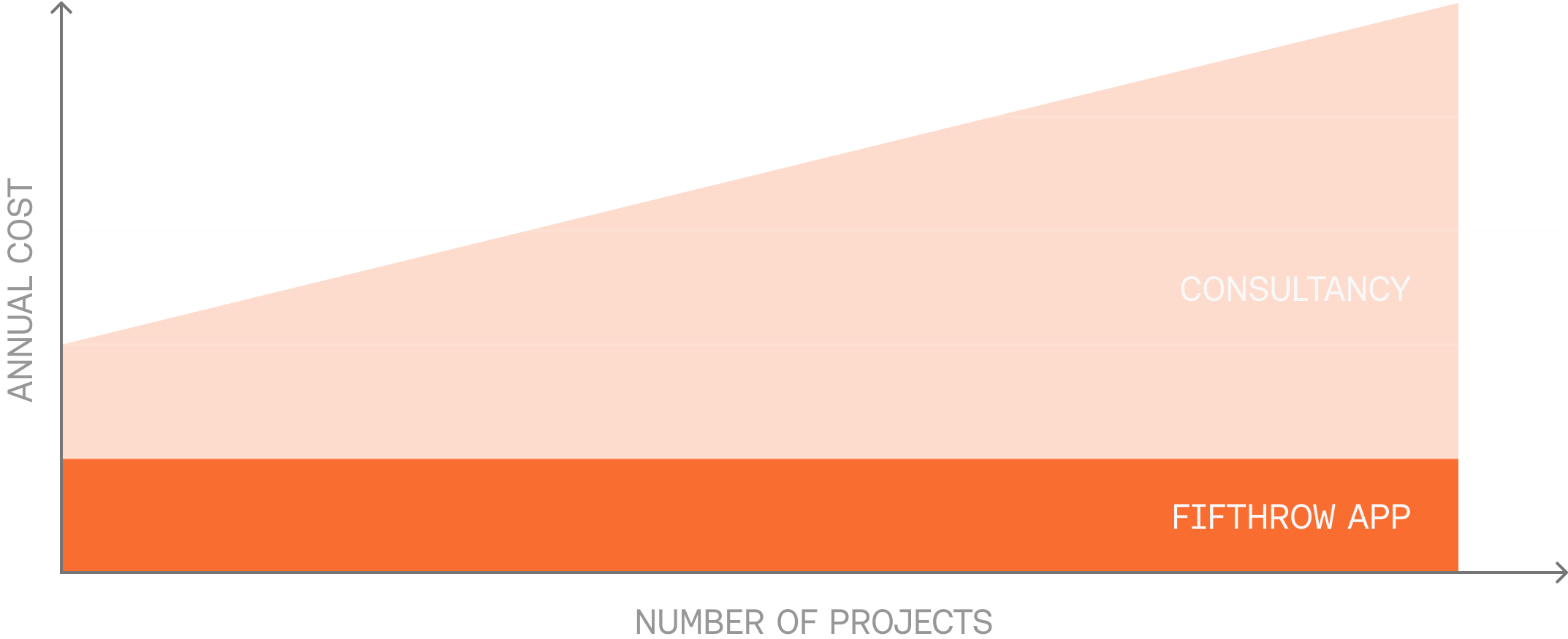

Scalable Use with Fixed Price

You don't pay an exorbitant hourly rate of a team you have not met. Once you have an App, you can run it as many times as you want.

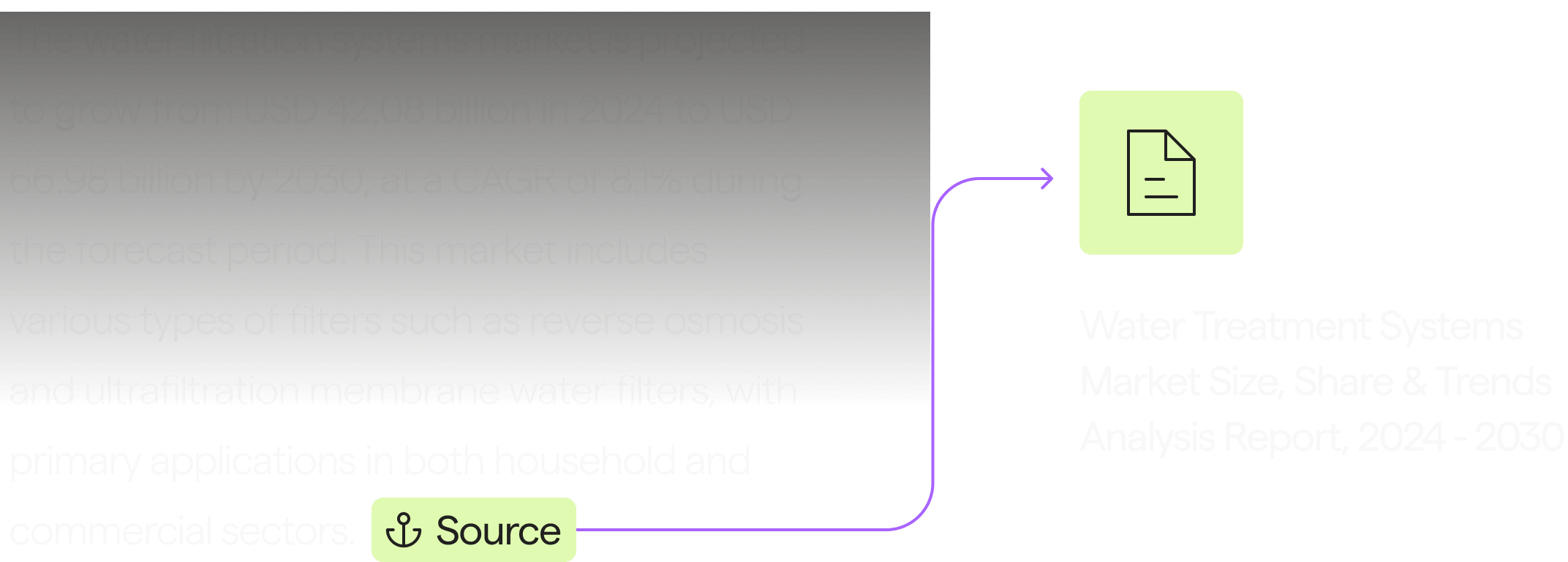

Fully Traceable Sources

Apps work on top of a joint dataset created by individual agents working on the project. All source data is linked and transparent.

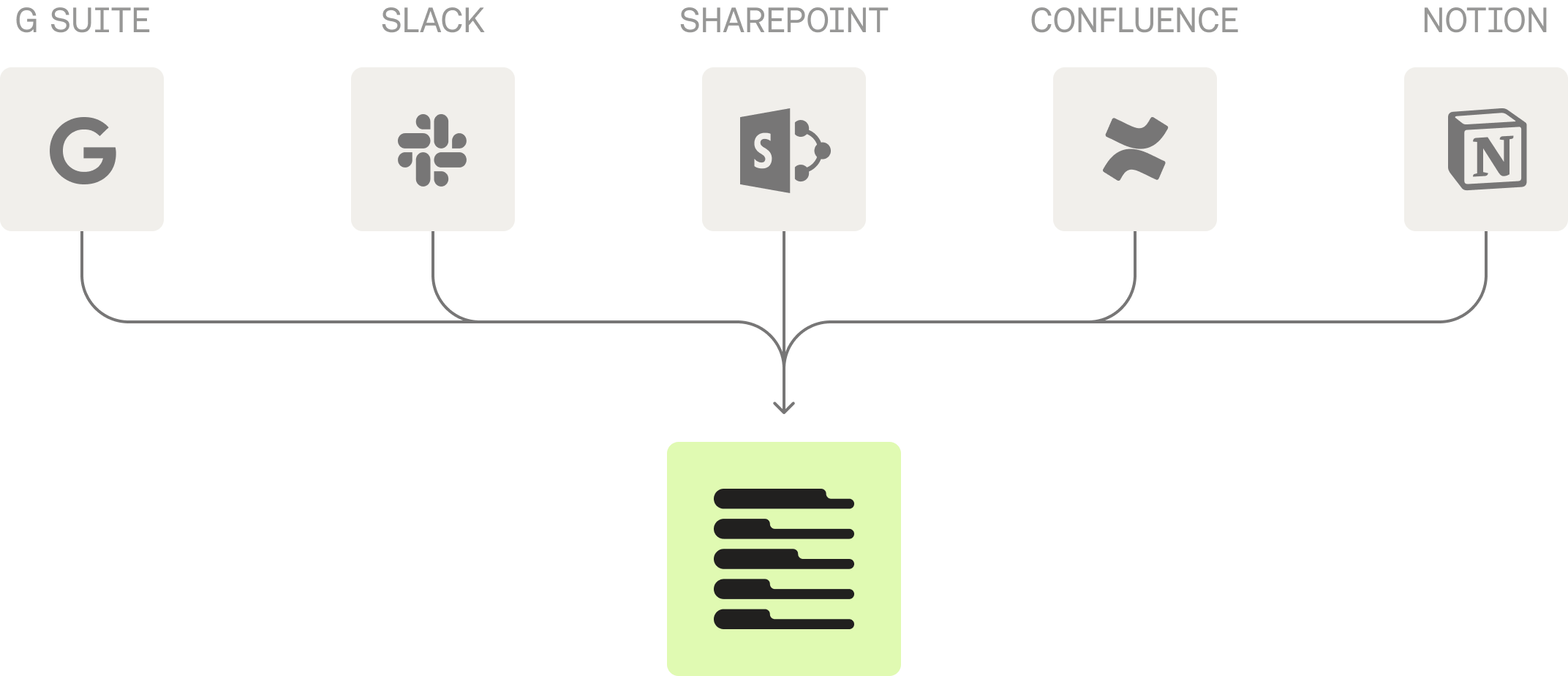

Connect Your Existing Data

Apps work on public and private data out of the box, and are SOC2 & GDPR compliant. We don’t train on, resell or package up your data.