Climate Risk and Resilience Evaluator

Assesses geographic risk concentrations and insurance policy vulnerabilities to climate-related events.

Geographic Risk Assessment

Policy Resilience Strategy Development

Clear business outcomes, such as cost savings and enhanced market resilience, by synthesizing insights from diverse data sources.

It provides actionable strategies for reinsurance and premium adjustments, helping insurers mitigate risks and optimize their portfolios.

Risk Management Officer needing to identify and mitigate geographic risk concentrations.

Insurance Underwriter requiring insights for policy adjustments and premium recalibrations.

Reinsurance Manager seeking strategies to optimize reinsurance coverage and costs.

Climate Risk Analyst evaluating climate-related vulnerabilities and their impact on portfolios.

55

AutonomousAgents

120

Research hoursequivalent

4-6 months

traditional consultancy1 week

With fifthrow app

Each App has meticulously pre-trained agents working on top of trusted data

FifthRow Apps are collections of Autonomous Agents working together to deliver comprehensive business processes and programs.

Customizable Agent Training for Vertical AI

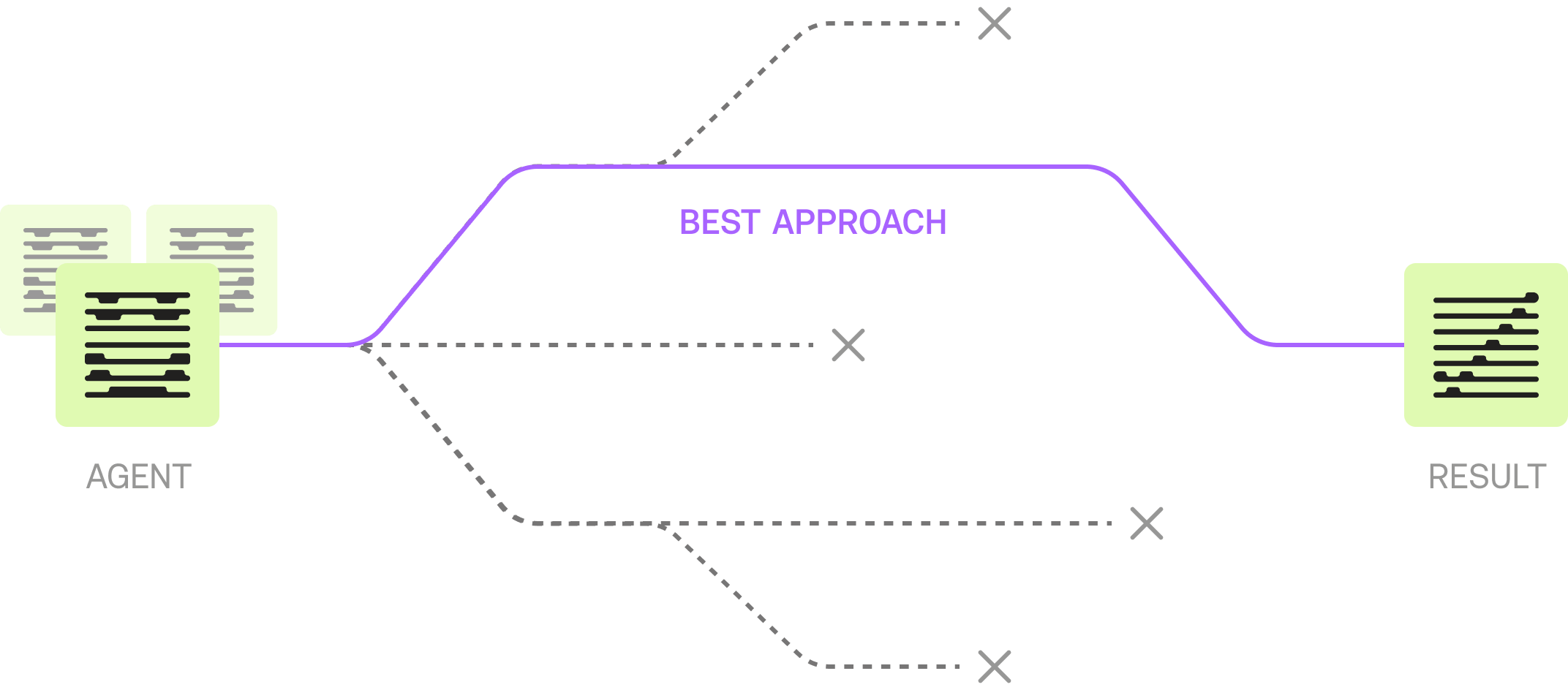

We pre-train all agents on multiple approaches to a problem. Every step is customizable and automates prompting, LLM choice and relevant data. All Apps are stress-tested 60+ times on multiple inputs for robust and consistent results.

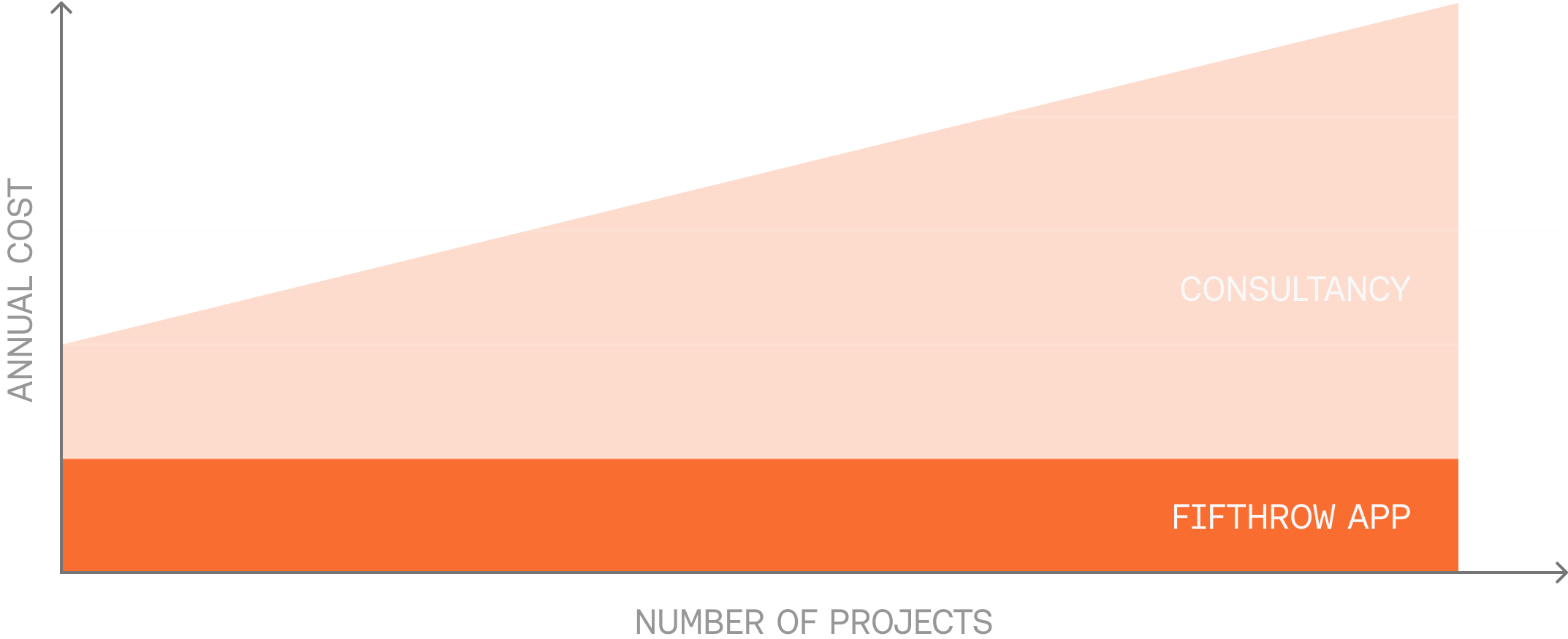

Scalable Use with Fixed Price

You don't pay an exorbitant hourly rate of a team you have not met. Once you have an App, you can run it as many times as you want.

Fully Traceable Sources

Apps work on top of a joint dataset created by individual agents working on the project. All source data is linked and transparent.

Connect Your Existing Data

Apps work on public and private data out of the box, and are SOC2 & GDPR compliant. We don’t train on, resell or package up your data.